loopsACCOUNTING: The Cloud accounting software that fits every business.

From invoicing to budgeting, advanced reporting and business analytics, everything you need to scale your business.

Subscribe NowGet your 30 day free trial

From invoicing to budgeting, advanced reporting and business analytics, everything you need to scale your business.

Subscribe Now

Experience the easiest accounting journey you can ever have.

Automate your routine business tasks with loopsACCOUNTING, like data entry and accounting, giving you more time to focus on what truly matters. Leave the tedious work to us and free up your schedule for important tasks.

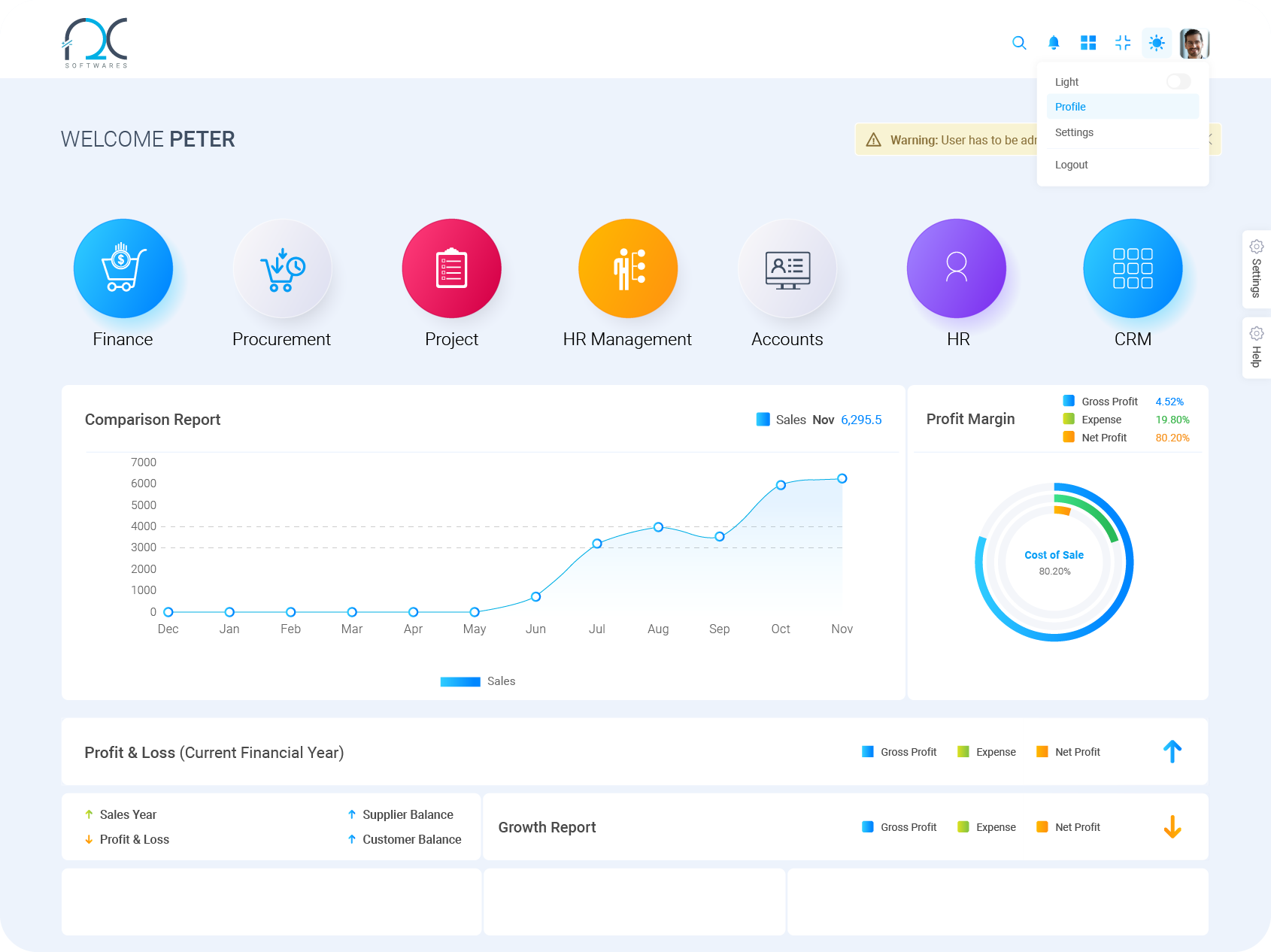

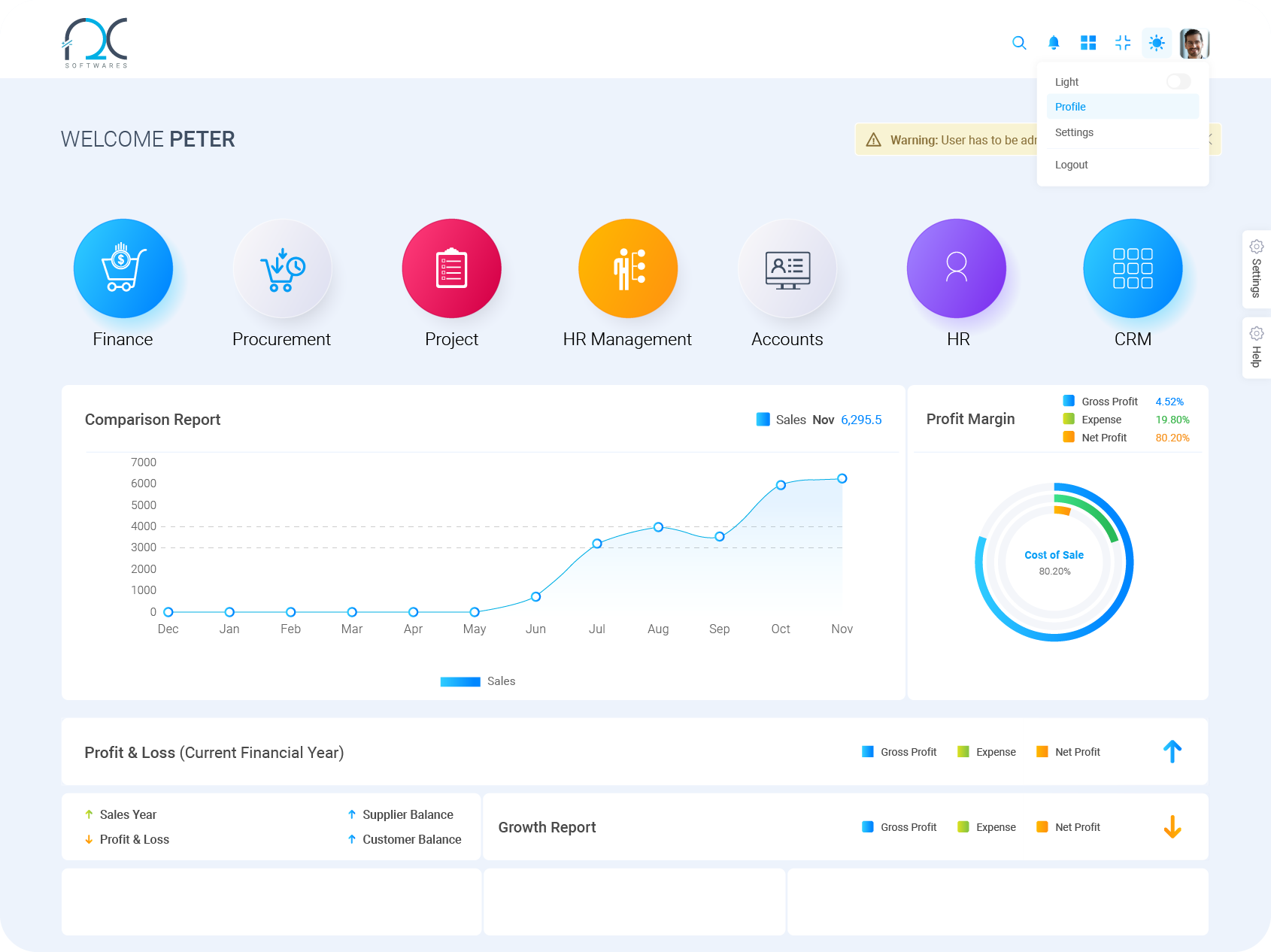

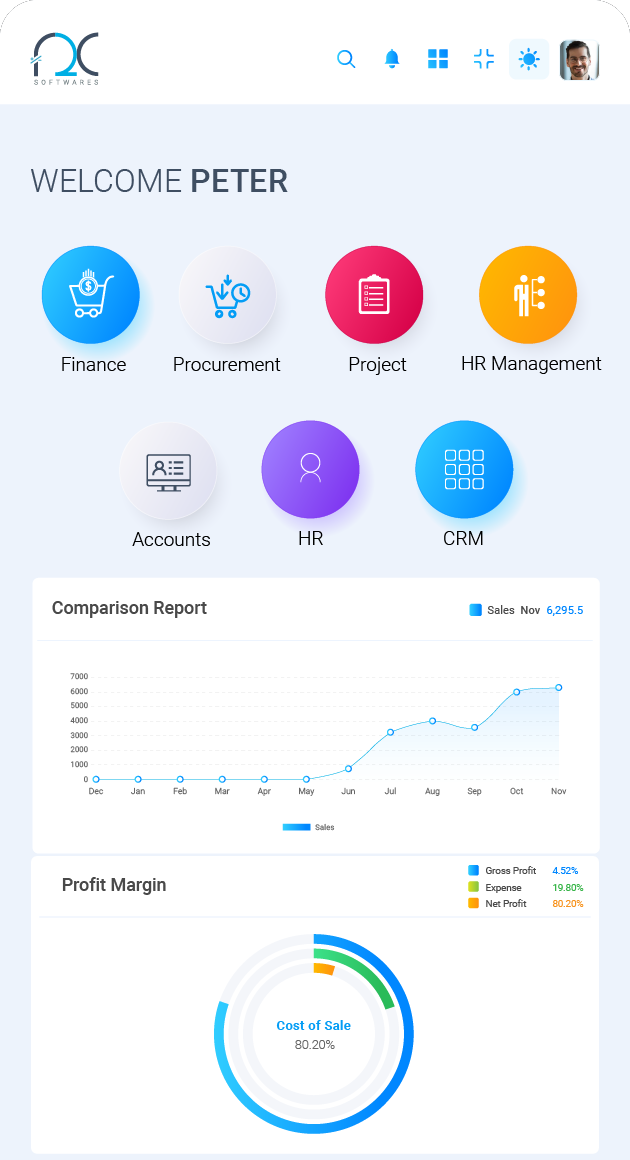

Make informed decisions with confidence. We provide you with real-time financial information, empowering everyone in your organization, from owners to managers, to make better decisions. Stay ahead of the game and seize opportunities as they arise.

Manage everything about your business with a single click. Easily manage your finances with loopsACCOUNTING-Track expenses, personalise invoices, generate reports, and so much more from one convenient place.

loopsACCOUNTING automates manual tasks and calculations. Boost the accuracy of your workforce while reducing the chances of human error. Enjoy the benefits of improved efficiency without breaking the bank.

loopsACCOUNTING allows multiple employees to view financial information and work on it simultaneously through an integrated finance module. The all-new cloud accounting software solution enables you to Experience seamless collaboration across your team and enhance your organization's teamwork and communication.

We're here to support your business throughout the journey. With loopsACCOUNTING, you have the freedom to adapt to changes and meet all your evolving requirements. Embrace the future with confidence.

We are a dynamic and passionate group of entrepreneurs with over 14 years of industry experience. We started as a brand called F2C, focusing on managing Facility Services and maintenance. Over time, we expanded our offerings to include Contracting, Interiors, IT Solutions, Trading, and Restaurants. Our overarching goal is to provide excellent service across all our endeavors, with a strong commitment to client satisfaction.

We aim to offer affordable solutions that prioritize user-friendliness. Our journey into software began with loopsACCOUNTING, a robust accounting software, and loopsERP, one of the best ERP softwares in UAE. Our primary focus is to develop software solutions that are straightforward and accessible to both novice and experienced users.

Don't just take our word for it. Check out what our satisfied customers have to say about loopsACCOUNTING- the powerful cloud accounting software!